Catch up:

Part 1 - Manage the existing business

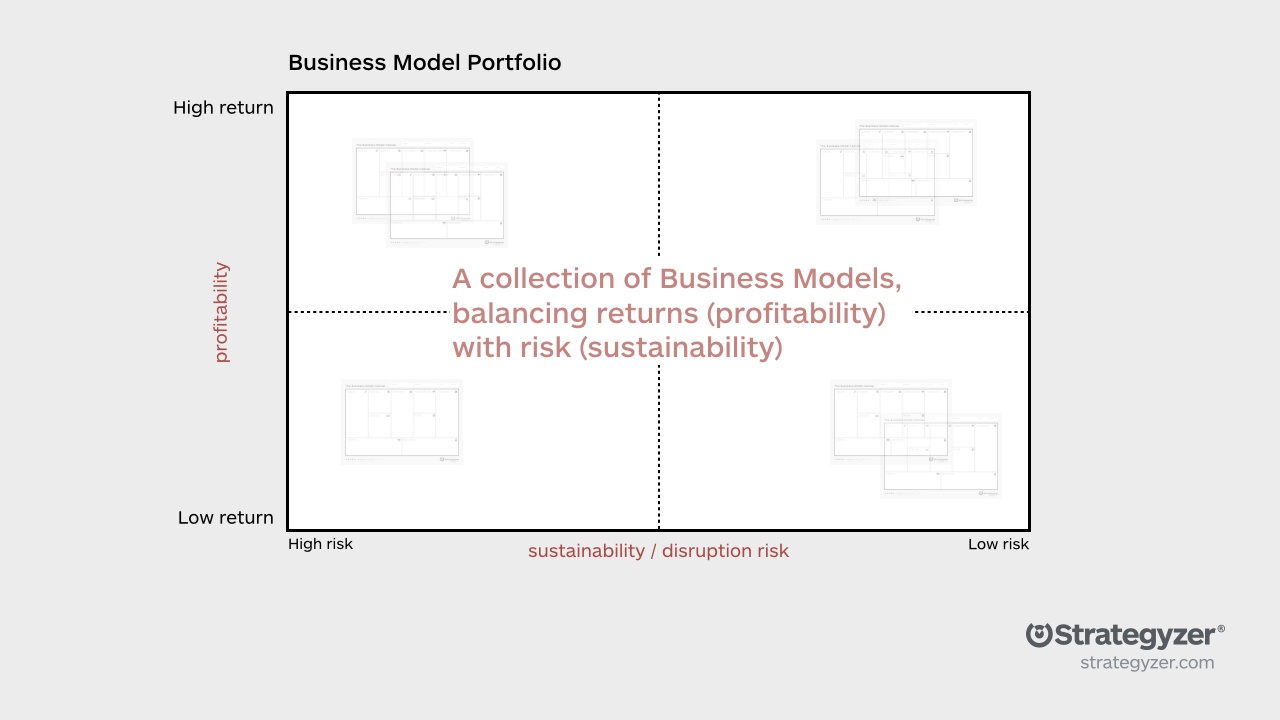

Part 3 - The Business Portfolio Map

In this post we explain the second part of our new Business Portfolio Map: the visualization of new business models and growth engines. The very best companies of our times excel at simultaneously managing existing businesses and inventing new ones is what. To visualize the portfolio of potential new businesses we use two axis, similar to the business model portfolio of existing businesses in part 1:

1. Expected return: Ideas and initiatives that have only limited potential to create substantial future revenues and profits go at the bottom of the spectrum. Limitations include size of market, revenue potential, pricing, etc. Business models with large potential revenues and profits sit at the top of the spectrum. Equally important here is to judge how robust a business model is: e.g. in terms of recurring revenues, long term growth, scalability, protection from competition, etc.

2. Innovation risk: On this axis you evaluate how much you de-risked a good looking business initiative. Ideas for which you have no evidence yet are very risky to invest in--these new initiatives sit on the left hand side. Ideas for which you rigorously test desirability, viability, and feasibility sit on the right hand side of the spectrum. The more you are confident an initiative will work based on tests and the resulting evidence, the more they move to the right. The more they are on the right hand side, the less risky they are to invest in.

It is important to point out that the invention of new businesses is a search process. Finding and validating a new growth engine is a very iterative process, contrary to the managing of an existing business.

In the second image we show the desired trajectory for every business (model) growth initiative: you aim to evolve it from a good looking idea to a carefully tested, validated and well designed business model with strong profit potential.The goal is to move every initiative to the upper right hand corner. A well designed business model has moats that protect it; an interesting and growing market; and it’s hard to disrupt.

Most of the time, the evolution to the upper right hand corner is not straightforward. Testing a business model could invalidate hypotheses, and require you to pivot the business model. It might also require you to go back and forth to the left hand side of the canvas to develop new prototypes and tests.

Business model initiatives at the upper right hand side are the ones you invest in and move to implementation. They become part of the portfolio of existing business models in the “execution engine”.

A well designed portfolio of new business models and growth engines has a large number of initiatives on the left hand side, because only a small number of those initiatives will make it to the upper right hand corner. Only a small number of initiatives will make it to implementation. To produce a real winner you need a substantial portfolio of initiatives of which many will fail.